Blog

How to Get Pay Stubs From Taco Bell in 4 Steps

Get pay stubs from Taco Bell by registering at their employee portal and accessing them online, or contact the payroll or HR department.

A Comprehensive Guide on How to Improve Family Finances

It is important to know how to improve family finances to allocate a budget for your basic needs and save enough funds for your long-term goals.

All You Need to Know About Pay Stubs With Voided Checks

A pay stub with voided check is used to set up electronic payment transfers, amend payroll mistakes, and record bank transactions.

Understanding Supplemental Pay: Examples, Exclusions, Taxation & More

Supplemental pay is additional income paid to workers on top of their regular wages. It includes tips, bonuses, overtime pay, and commissions.

A Comprehensive Guide on How to Protect Your Pay Stubs

Knowing how to protect pay stubs effectively is the key to safeguarding employees and companies from identity theft and phishing scams.

A Comprehensive Guide to Variable Pay: Definition, Types & Advantages

Employers use variable pay to incentivize employee productivity and achievement. It includes bonuses, salary increases, and commissions.

12 Examples of Fringe Benefits & How They Work [Full Guide]

Fringe benefits are monetary and non-monetary benefits employers offer to boost employee morale and reward their work performance.

8 Common Payroll Questions Employees Often Ask + Answers

The most common payroll questions that employees frequently ask often involve their salaries, withholding taxes, and other salary adjustments.

8 Common Payroll Errors & How to Avoid Making Them

The most common payroll errors include misclassifying employees, miscalculating salaries, and missing payroll deadlines.

How To Recognize & Avoid W-2 Scams: Comprehensive Guide

W-2 scams refer to fraudulent activities designed to phish employees' tax information and other personal details declared on their W-2 forms.

How to Get Pay Stubs From Walmart: 4 Methods Explained

Get pay stubs from Walmart through the OneWalmart portal or the WalmartOne app. You can also check your email or consult HR.

How to Get Pay Stubs From DoorDash? Full Explanation

You can get pay stubs from DoorDash by sending a request to DoorDash Support, using Truework Verification, or generating your pay stubs.

Complete Guide on How to Get Pay Stubs From Starbucks

You can get pay stubs from Starbucks through the Starbucks Partner Hub or app, direct deposit, the branch's payroll provider, or HR.

What Are EFT Pay Stubs? A Full Guide to Income Verification

EFT pay stubs are electronic paychecks created alongside online, cashless systems that process and send employees' salaries.

How to Calculate How Many Pay Stubs is 30 Days Worth

To determine how many pay stubs is 30 days worth for each pay schedule, divide 30 days by the number of days covered in each payroll period.

Is a Pay Stub Proof of Residence? How to Prove Your Address

Is a pay stub proof of residence? Yes, but banks deem it insufficient to prove one's address, and it is often best paired with other valid documents.

When and How Should You Edit Your Pay Stubs [Full Guide]

It is crucial to learn how to edit a pay stub if you encounter errors in your personal information, rates, number of hours worked, or deductions.

How to Get a Loan With Pay Stubs: Full Guide

Securing a loan with pay stubs entails preparing the latest copies of your pay slips, while having a high credit score and a good debt-to-income ratio.

How to Choose a Pay Stub Generator: The Ultimate Guide

Here's how to choose a pay stub generator: first, consider your company size and budget, and then look for secure, user-friendly, and practical features.

How to Provide Proof of Income For a Mortgage

Proof of income for a mortgage includes pay stubs, tax returns, bank statements, invoices, profit and loss statements, and credit reports.

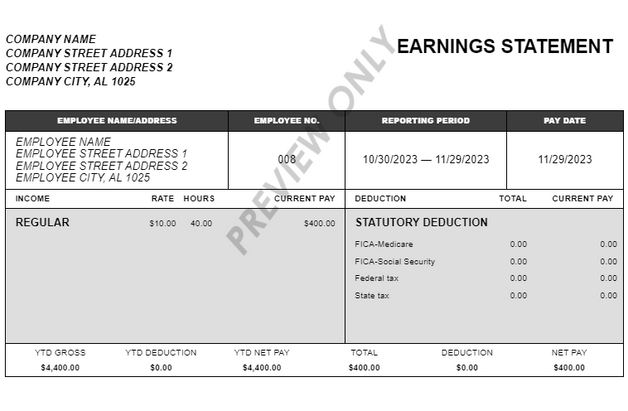

Pay Stub Images: Real Paystub Examples and Pictures

Pay stub images are visual representations of different pay stub templates used in different business industries and work setups for employees.

What is Bimonthly Pay? Benefits, Disadvantages & More

A bimonthly payroll is a pay period wherein employers release employee paychecks twice a month. It entails 24 pay cycles annually.

HSA Contributions: How to Find Them on Your W-2 Form

HSA contributions are funds set aside on a pre-tax basis that eligible individuals can withdraw to cover qualified medical expenses.

What is Comp Time? Compensatory Time Explained by Experts

Compensatory time refers to the paid time off granted to employees for accumulating extra work hours in a given pay period.

How to Choose The Right Filing Status When Filing Your Taxes

A taxpayer's filing status helps determine their taxable income amount, standard tax deductions, and eligibility for specific tax credits.

Top 9 Strategies on How to Reduce Taxable Income

Some of the best ways to reduce taxable income include HSA contributions, long-term capital gains investments, college savings funds, etc.

Loans For Unemployed People: Proving Income With Pay Stubs

The best loans for unemployed people include guarantor loans, home equity loans, buy now, pay later payments, and specialist loans.

How to Find & Interpret Vacation on Your Pay Stubs

Vacation on pay stubs outlines the total number of paid time off that each employee has accrued over the course of their employment.

11 Types of Loans Explained: Learn How to Qualify for a Loan

Learn the different types of loans for individuals and businesses based on their purpose and the presence or absence of collateral security.

Pay Stub vs. Bank Statement: Discovering the Key Differences

When comparing a pay stub vs. a bank statement, the crucial distinction is that the former is prepared by employers, while the latter is issued by banks.