Do Pay Stubs Have SSN? Its Meaning & Importance on a Stub

February 23, 2024

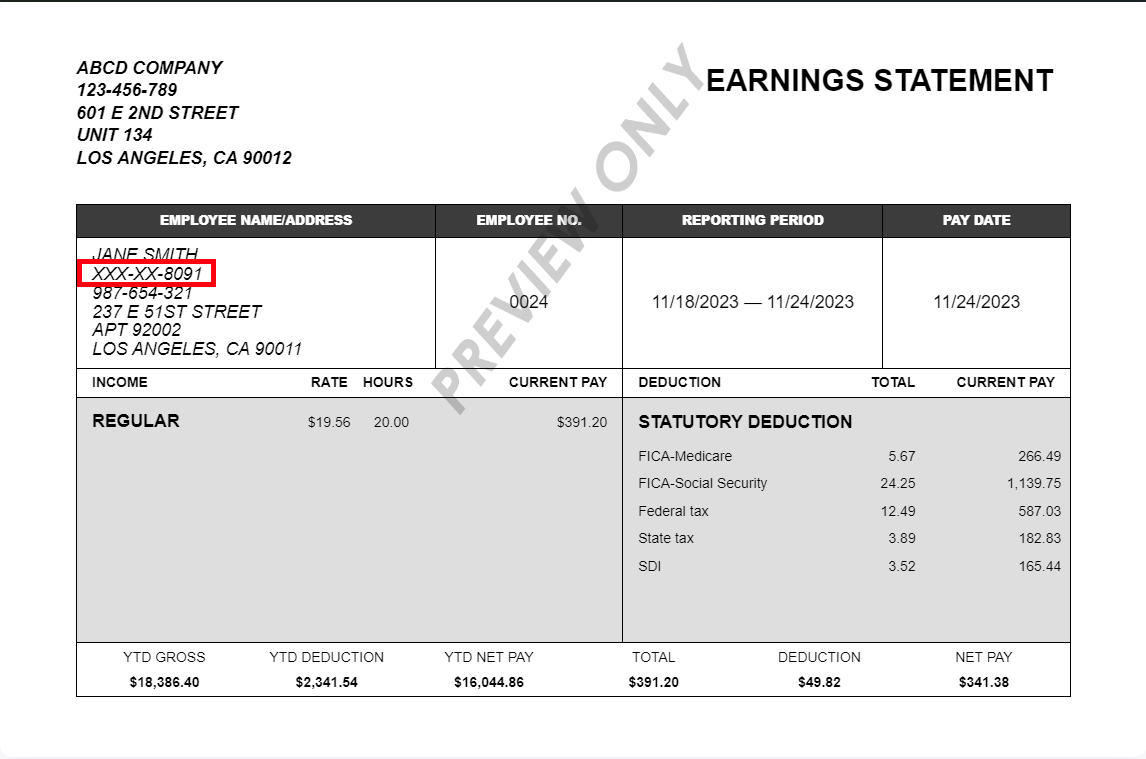

Do pay stubs have an SSN? The straightforward answer is yes. All pay stubs contain an employee’s SSN, or social security number.

A social security number is a nine-digit code issued to all US citizens, and it is essential to monitor each taxpayer’s income statements and tax returns. Not to mention, Social Security taxes are part of the federal taxes withheld from employees’ salaries.

There’s more to learn about your social security number and why having it on your paycheck is essential. Also, it is worth understanding other important information on your pay stubs.

We’ll tackle all that in this article, so let’s begin!

Key Takeaways

- Pay stubs have SSN and typically show only the last four digits of a taxpayer or citizen’s unique nine-digit social security combination.

- A social security number is a nine-digit identifier the Social Security Association assigns to all permanent, temporary, working, and non-working US citizens.

- SSNs are instrumental in tracking wages and Social Security benefits, applying for unemployment assistance and federal loans, opening a bank account, or acquiring a driver’s license or passport.

- Colorado and California require employers to include their employees’s social security numbers in their paychecks.

Do Pay Stubs Have an SSN?

Yes, pay stubs have an SSN, and it is an essential piece of information found on most employees’ paychecks.

Paychecks containing a social security number are more reliable and valid, considering that the federal government also issues an SSN. An SSN indicates that employees pay their taxes and that their employer practices transparency in preparing their salaries and paycheck information.

While the FLSA and federal law do not require employers to issue pay stubs, state laws and pay stub requirements impose regulations on businesses when preparing their employees’ pay statements.

Some states implement restrictions and requirements for granting employees access to their pay stubs, while others are more specific regarding the information employers must include in paychecks.

Colorado and California explicitly mandate employers include their employees’ SSN information on their pay stubs. Meanwhile, Alabama, Arkansas, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee do not have any provisions for pay stub information.

Other states, such as Wyoming, Montana, New York, Indiana, and Connecticut, require that employers declare their employees' gross and net earnings. These states also oblige businesses to specify itemized deductions, pay period dates, pay rates, and overtime compensation.

What is a Social Security Number (SSN)?

A social security number (SSN) is a unique nine-digit number identifier that the Social Security Administration (SSA) issues to all US citizens and permanent residents. Temporary residents, as well as working and non-working residents, may also acquire an SSN.

You can get a social security number by obtaining and filling out Form SS-5, Application for a Social Security Card.

The SSA primarily uses the assigned social security numbers to track and report each taxpayer’s wages and Social Security benefits to the government.

Paystubs with SSNs also prove instrumental for the following purposes:

- Calculating possible benefits you may qualify for, such as health insurance, disability, and retirement income

- Applying for unemployment benefits

- Signing up for Medicare

- Opening a bank account

- Obtaining a driver’s license or passport

Older versions of SSNs followed a specific number pattern that made it easier for scammers to steal taxpayers’ identities. The older pattern consisted of an area, group, and serial numbers.

Modern technology has enabled randomization to create multiple and unique social security number combinations that are difficult for individuals and fraudsters to guess.

Contact the Social Security Administration if you suspect your identity was stolen using your SSN.

What Information Can be Found on a Pay Stub?

Pay stubs have an SSN and other essential information about the employer, employees, and their salaries.

Many businesses use HubSpot integrations to connect payroll and HR systems, keeping employee and salary information synchronized across platforms.

Listed below are other key details you can find on a pay stub:

#1. Personal Information

Personal information applies to both employers and employees. It includes the employer's and employees’ names, contact information, and addresses. Also included under personal information are the employee’s employee ID and social security number.

#2. Gross and Net Salary

The gross salary is the employee's total income earned in a pay period before taxes and other deductions are subtracted from their wages. Meanwhile, the net salary refers to employees’ earnings after taxes.

The net salary is the amount employers deposit into their employees’ accounts every payday.

#3. Federal Income Tax

Federal income tax is the tax the IRS imposes on employees, individuals, businesses, and legal entities’ annual income and earnings. Employers withhold a specific percentage of employees’ earnings to pay their taxes.

Employees' federal income tax rates are based on their filing status and tax brackets.

#4. State Taxes

State taxes are the state-level counterpart of federal income taxes, with tax rates that vary per state. State governments impose taxes on their constituents to help fund their programs and activities to maintain and preserve the community.

Like how a select number of states require pay stubs with SSNs, state taxes are not imposed across all states. Alaska, Florida, Wyoming, South Dakota, New Hampshire, Texas, Nevada, and Tennessee do not levy state taxes.

#5. Other Deductions

Other deductions include voluntary contributions to insurance premiums and retirement accounts. If a court mandates an employee to pay wage garnishments, employers are obliged to withhold the needed amount to pay the amount required from their staff.

Group term life insurance and union dues are deducted from employees’ gross earnings, if applicable.

#6. Hours Worked & Rates

The number of hours worked is typically reflected on employees’ pay stubs to reference their earnings in a given pay period. Meanwhile, the rates refer to the amount paid to an employee per hour.

Some employees are paid per hour, while others have a fixed salary rate. The number of hours worked multiplied by the worker’s rate yields their total gross income in a pay cycle.

#7. Bonuses & Other Adjustments

Some employers offer monetary incentives to their staff for a job well done. Whether the bonus is a salary increase or commission on top of their regular salary, these financial rewards are typically declared on employees’ paychecks.

Similarly, any adjustments in workers’ earnings and benefits reflect on their paychecks. These adjustments may be due to a miscalculation from the previous payroll or a change in an employee’s remaining number of PTOs.

Create Your Pay Stubs With Paystub.org

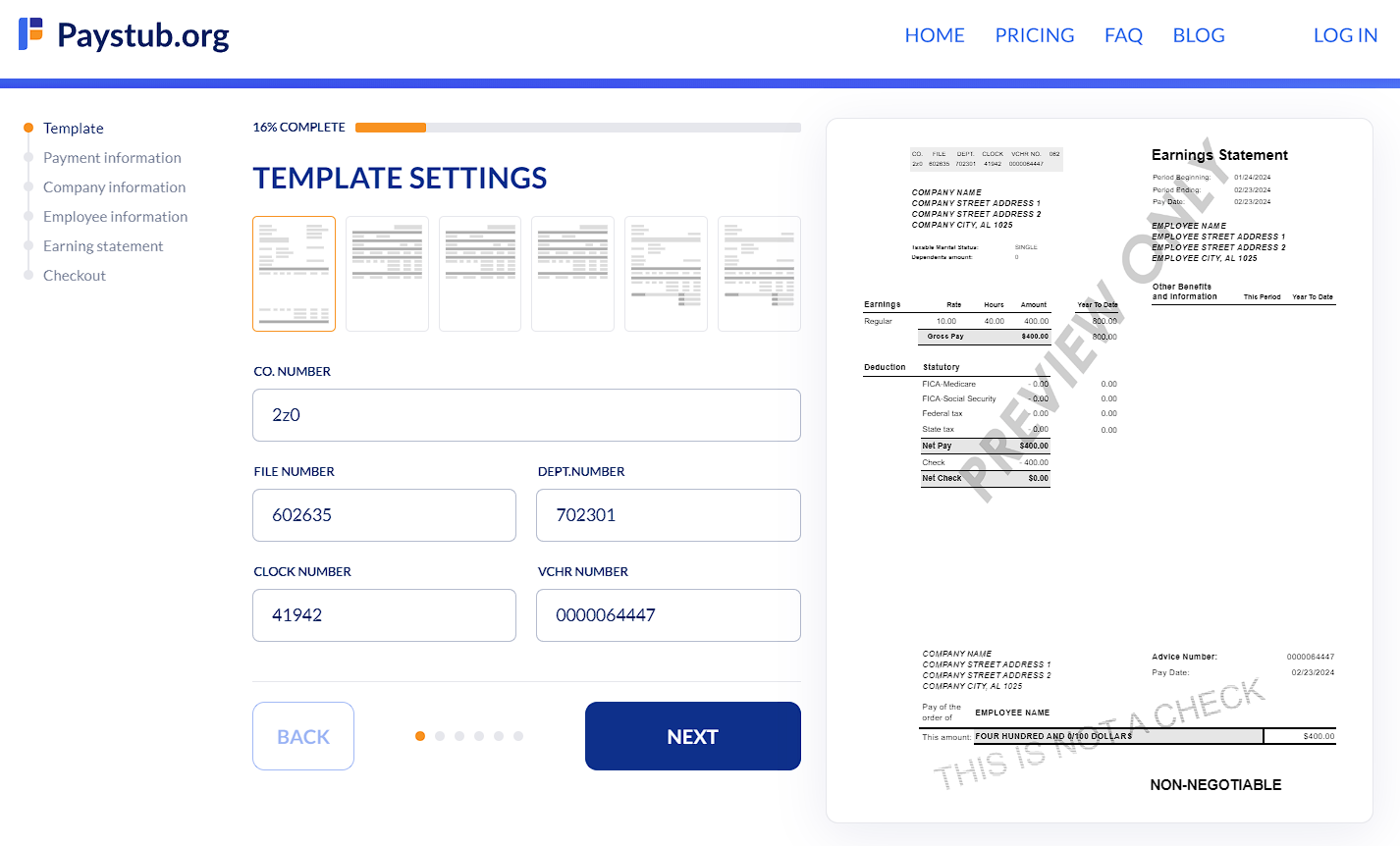

Need help generating pay stubs for proof of income, proof of identity, a loan application, or an apartment rental? Our paystub generator is just the tool you need!

What makes our generator stand out among other pay stub generators in the market?

We offer templates that you can choose from to ensure your pay stub has an SSN and all the other necessary information about your salary. Our pay stub generator also comes with a built-in tax calculator for easier and more accurate computation of your taxes.

Create as many pay stubs as you need in minutes!

Final Thoughts

Paystubs do have SSNs, and that is because your social security number serves as a unique and reliable identifier that you can use to monitor your taxes, check your Social Security benefits, and prove your identity to banks and financial institutions.

All the information and abbreviations you see on your paycheck are there for a reason, and knowing what each detail stands for will benefit you in the long run.

Do Pay Stubs Have SSN FAQ

#1. Can I submit pay stubs as proof of my social security number?

You can submit your pay stubs as proof of your social security number, particularly if your pay stub has an SSN. Aside from your pay stubs, you can also use your Social Security card, Form W-2, Form 1099, or 1040 Tax Return.

#2. Is it safe to email pay stubs?

Yes, it is safe to email pay stubs, provided you attach them as a PDF file in the email and use encryption. Use secure email providers such as Gmail, ProtonMail, or HubSpot. Doing so prevents hackers from intercepting all the information and files contained in the email.

#3. Does a W-2 form have an SSN?

Yes, a Form W-2 contains a taxpayer’s SSN, like a pay stub with a social security number. The social security number is reported in Box A of the said form, bearing only the last four digits of your nine-digit SSN combination to prevent identity theft. Either asterisks or big letter Xs replace the first five numbers.

#4. Can I print my SSN on my pay stub?

Yes, you can print your SSN on your pay stub using a pay stub generator. Unfortunately, only the last four digits of your social security number will appear on your payslip by default.

This is due to the labor code prohibiting employers from including their employees' complete SSNs on their paychecks.

Related articles

You can also check out our blog if you need an in-depth answer to stub-related questions such as: