What is Annual Payroll and How to Calculate It: Full GuideForm 940

April 05, 2024

Annual payroll is the total wages and salaries an employer pays their staff for the entire calendar year. Preparing annual payroll reports is a must for companies to prove their due diligence in fulfilling their obligations to their employees.

It is also instrumental in helping employers keep their business expenses in check and fully comply with IRS and labor regulations.

Unlike your usual payroll reports, summarizing all your company’s completed pay cycles is more extensive and requires more time to prepare. Fortunately, our resident payroll experts are here to explain the step-by-step process of calculating and preparing your annual payroll report.

Let’s begin!

Key Takeaways

- The meaning of annual payroll is defined as an overview of all wages, salaries, and bonuses paid to employees. It also reports all taxes and deductions imposed on each worker’s gross earnings.

- Employers must fulfill and submit IRS Form W-2, Form W-3, Form 940, and Form 944 when preparing their annual payroll.

- Calculating employees’ gross wages or income, bonuses, deductions, and net pay is a necessary part of calculating a company's annual payroll.

- To finalize the business’s annual payroll data, employers must update employee information, file the relevant tax documents, reconcile payroll taxes, and compile all payroll information and updates accumulated for the calendar year.

What is Annual Payroll & Why is it Important?

An annual payroll summarizes all income and wages paid to employees. It includes all federal, state, and local taxes withheld from employees’ salaries and voluntary deductions subtracted from their gross pay.

Ideally, startups, mid-sized enterprises, and even large corporations should prepare their annual payroll to outline all operational costs for the year and ensure full payment of payroll and income taxes. Understanding the steps to set up payroll for small businesses can help streamline the process and prevent costly errors.

If not, they may miss major discrepancies in their payroll and tax data and potentially face penalties or an IRS audit.

All annual payroll data and reports must be ready by the end of the calendar year. Some businesses furnish their annual payroll summaries at the beginning of the new calendar year, just in time before distributing their employees’ W-2 forms.

Other Types of Payroll

Other types of payroll cycles or pay periods are much shorter than annual payroll, namely:

- Weekly payroll. In a weekly payroll, employers prepare employee wages, benefits, and tax deductions at the end of each week. It is the most costly and rigorous type of payroll.

- Biweekly payroll. The biweekly payroll is the most widely used pay cycle in the U.S. Employers who implement this payroll variation pay their employees twice a month and complete 26 pay periods annually.

- Semimonthly payroll. A semimonthly payroll also pays employees twice a month, but the difference is that employers release salaries at fixed dates, which usually fall on the 1st and 15th or the 15th and 30th or 31st of the month.

- Monthly payroll. A monthly pay structure often suits salaried employees. Employers process their payroll once a month or 12 times a year.

Components of Annual Payroll

Like a weekly, biweekly, semimonthly, and monthly payroll, an annual payroll also has critical components that outline all the crucial information about a business’s payroll and operational costs.

#1. Wages and Salaries

Wages and salaries are paid to employees in exchange for their work. Wages are paid to hourly employees, while salaries are fixed rates for regular or W-2 employees.

Employers must compute the annual wages and salaries paid to employees for the calendar year. In the annual report, the total wages and salaries are typically grouped per month, next to each employee’s monthly work hours.

#2. Bonuses and Overtime

Bonuses can be performance-based or given as incentives for helping the company boost sales or recruit new talent. Several different types of bonuses, such as spot bonuses, commissions, and holiday bonuses, must be declared in employees’ payroll reports.

On the other hand, overtime pay is reserved for non-exempt employees. Non-exempt employees are paid hourly rates. Hence, they are entitled to overtime compensation when they complete more than the required work hours in a week.

#3. Taxes

Employers must withhold federal, state, and local taxes from their employees’ gross wages and salaries.

Federal taxes are levied on all types of income earned or paid to workers and employees, including their regular income, tips, bonuses, commissions, and even money earned through investments or passive income sources like rental properties or dividends.. Federal tax rates are based on employee filing status and tax brackets.

Employers must also withhold their workers’ income percentages to pay FICA taxes.

State and local tax rates vary per location. Not all state and local governments impose income taxes on their constituents.

Employers are solely responsible for paying FUTA and SUTA taxes. Depending on the state regulations that apply, coverage for the latter may be shared between employers and employees.

#4. Deductions

Deductions refer to the contributions withheld by employers from employee earnings to pay for life and health insurance and retirement benefit coverage. Other forms of deductions also include wage garnishments and union dues.

4 Steps to Calculate Annual Payroll

The steps in calculating annual payroll include calculating the three essential values: employees’ gross salaries, the deductions applied to each employee’s gross income, and their net pay, or the amount left of their earnings after taxes and deductions.

Step 1: Calculate Gross Salary

Calculating the gross salary or wages entails multiplying the employee’s regular or hourly rates by the total work hours they completed in each pay period. It is best to calculate monthly gross salaries for annual reports.

As such, if employees are paid twice a month, employers must combine the total gross earnings of each staff member for the two pay frequencies completed each month.

Here’s an example to help you visualize it better:

Fixed Rate | Work Hours | Gross Pay |

|---|---|---|

$12.59 per hour | 80 | $1007.2 |

Employees are paid a fixed rate of $12.59 per hour and must complete 80 work hours every pay period. To get their gross pay, multiply $12.59 by 80. The result, which is $1007.2, is the employee’s gross pay.

Follow the same formula for hourly employees. Note that the number of hours per pay period changes for hourly employees depending on how frequently they are paid. If paid weekly, they must complete 40 work hours each pay period.

If a worker’s hourly rate is $10.45, then using the formula above: $10.45 X 40 hours per week = $418 weekly gross wage.

Hourly Rate | Number of hours per week | Gross Wage |

|---|---|---|

$10.45 | 40 | $418 |

Step 2: Calculate Deductions

The deductions applied to workers’ gross pay include their federal, state, and local income taxes and contributions to insurance coverage and retirement benefits.

If they are court-mandated to pay garnishments for alimony, loan payments, or child support, employers must deduct the required amount from their staff’s gross earnings.

Employers must itemize all deductions on the annual payroll report to ensure full transparency and accuracy in calculating each staff member’s net pay.

Step 3: Calculate Bonuses

The bonuses may vary per employee, depending on the type of bonuses the company grants. However, bonuses must be included in preparing the annual payroll report because they comprise a portion of the company’s expenses.

For instance, if the company pays performance incentives, the bonus must be recorded in the employee’s employment data for future reference in case the employee qualifies for another performance bonus.

Holiday pay or bonuses must also be noted and calculated for employees eligible for the said additional pay, mainly since holidays are included in the calendar year that comprises each annual payroll.

Step 4: Calculate Net Pay

Net pay, or income, is the total earnings after subtracting taxes and other necessary deductions from wages and salaries. It is also the amount that employees receive in their accounts at the end of each payroll cycle.

4 Tasks to Wrap Up Annual Payroll

Wrapping up the annual payroll data is the next step in preparing the annual payroll. It entails verifying the correctness of all payroll and employee information and helping businesses check that they have the necessary tax forms ready.

Let’s take a closer look at each of the tasks:

#1. Update Employee Records

Updating employee records entails inputting any change in their information directly affecting their taxes, salaries or wages, and eligibility for specific benefits and tax deductions.

For instance, when employees move up a tax bracket due to a recent promotion, add or declare dependents on their Form W-4, or change their filing status, the changes should be reflected in their employment records.

Similarly, if some workers shift from a full-time to a part-time position, their shifts and rates should also show up in their recent files.

Aside from their tax details, benefits, deductions, and rates, other key employee details to keep up-to-date include paid time off and overtime hours. Monitoring paid time off for salaried workers helps determine whether an employee qualifies for reimbursement of their unused leaves.

Doing so enables the payroll personnel to check the remaining PTO of each staff member and ensure that the updates are reflected on the payroll system for the following year.

#2. Prepare and File Relevant Forms

A typical annual payroll report consists of the following IRS forms:

- Form W-2. Also called the Wage and Tax Statement, it reports all the necessary information about the yearly wages, bonuses, and tips paid to an employee and summarizes the total taxes withheld from their earnings.

- Form W-3. The Transmittal of Wage and Tax Statements, or Form W-3, outlines all W-2 forms submitted to the IRS and other government agencies.

- Form 940. This tax form reports the annual unemployment tax amounts covered or paid directly by businesses. Employers who hire workers for 24 hours within a 20-week period or more and pay at least $1,500 in wages must fulfill their Employer’s Annual Federal Unemployment Tax Return.

- Form 944. Form 944, or Employer’s Annual Federal Tax Return, is reserved for employers filing $1,000 or less worth of annual tax liability. It is an alternative to IRS Form 941, Employer’s Quarterly Federal Tax Return, which employers use to report all income taxes withheld from employees’ wages and salaries.

#3. Reconcile Payroll Taxes

Reconciling payroll taxes entails comparing the total amount paid for the business and employees with the information on the company’s payroll register. Ideally, businesses must reconcile payroll taxes after every pay period, both quarterly and annually.

The key is to continuously verify that the company or organization pays the correct amounts for the taxes owed by the business and its employees.

#4. Compile Annual Payroll Data

When compiling the annual payroll data, create a separate yearly summary for each employee that itemizes their total regular work hours, overtime hours (if applicable), and gross and net monthly wages.

Doing so prevents the payroll information for each worker from getting mixed up. At best, using payroll software and online tools ensures precision in determining the values needed to keep all payroll data up to date.

5 Strategies For Efficient Management of Annual Payroll

The following strategies for efficient annual payroll management help align your payroll processing strategies with the necessary steps in preparing your annual payroll summary.

#1. Ensure Law Compliance

Prepare your annual payroll according to IRS regulations and any other specific laws imposed by your state or local government. Also, make sure to follow the payroll deadlines and tax filing due dates regardless of whether you pay employees weekly, biweekly, semimonthly, or monthly.

If you have non-exempt employees, ensure their overtime hours are appropriately accounted for. Check with your state office for changes in the state income tax rates or verify whether you must pay SUTA taxes.

Furthermore, ask the local authorities about any specific pay frequency and pay stub requirements in your area.

#2. Regularly Review & Update Data

Compare and periodically review all employee information, accrued expenses, and operational costs. If you use an employee portal to process your payroll, have employees check their employment information occasionally.

Instruct your staff to inform the HR and payroll department immediately of any relevant changes in their tax information and filing status. It would also be best to securely discard payroll data from several years ago to make way for new information crucial to your current workforce.

#3. Outsource Payroll Services

Outsourcing payroll services works if you have a limited workforce but want to save on the costs of hiring in-house personnel to manage your payroll.

Some payroll functions you can outsource include:

- Managing payroll and income taxes

- Setting up payroll accounts

- Fulfilling annual payroll reports and end-of-year tax filing

- Implementing security measures to protect business and employee data

- Practicing full compliance with federal and state regulations

Find a payroll outsourcing partner whose services suit your business needs and your budget.

#4. Conduct Regular Payroll Audits

Payroll audits refer to the process or steps involved in evaluating and reviewing your annual payroll's information, documents, and values.

When auditing your payroll, it is crucial to certify that each employee is paid the correct gross and net wage according to the introductory rates indicated in their employment contract.

At the same time, the process requires levying and subtracting the correct percentages to pay taxes and all mandatory and voluntary deductions.

Ideally, employers must conduct regular audits independently, with or without an order or request from the IRS. In other words, take the initiative to inspect your quarterly and annual payroll data to detect and resolve inconsistencies before the IRS or the government identifies them.

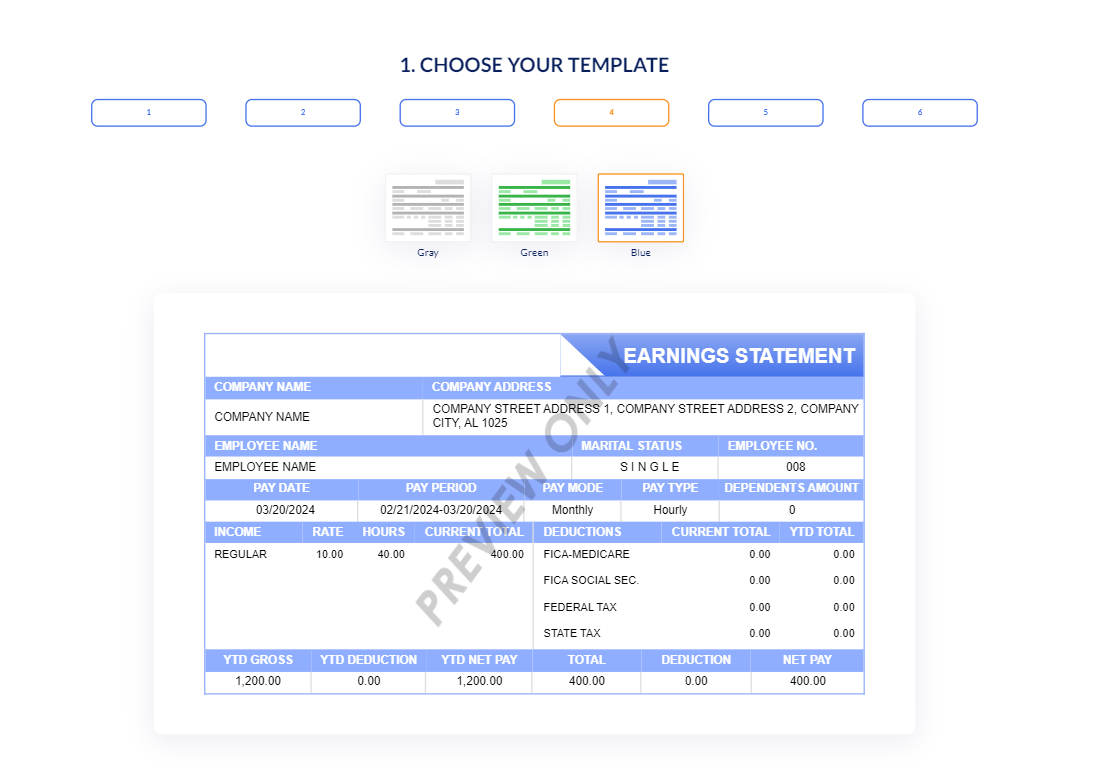

#5. Use a Paystub Generator

A paystub generator and other similar online tools are simple yet cost-efficient tools that help regulate payroll responsibilities.

If you are catering to a growing number of employees, you can use Paystub.org’s generator to speed up the time it takes to prepare pay stubs for every pay period. Use our templates to reduce errors when inputting your employees' pay and tax information.

Our pay stub generator also includes a built-in calculator to ensure your employees' paychecks reflect the correct gross and net pay values.

Final Thoughts

Preparing your company’s annual payroll can be tedious, given the bulk of information you must review, prepare, and submit.

The best way to regulate all the responsibilities of creating an annual payroll report is to conduct regular and advanced data auditing and organization. Don’t wait until the end of the year to start verifying each staff member’s employment and pay information.

Work smarter by dividing the workload per quarter or pay period and combining the advantages of employing both a manual workforce and automated tools. Use this article as your guide, or check out our blog post on payroll processing for more helpful tips!